Much like with any type of recurring expense, you require to pay your auto insurance policy costs routinely or your insurance firm will quit supplying coverage. But unlike a missed phone costs, the effects of missing out on an insurance settlement can be far-reaching. After a cancellation for a missed repayment, the insurance provider can boost your prices and also your permit may be revoked - auto.

It's important that you contact your insurer as soon as you recognize you're behind on your insurance settlements. trucks. What to do if you can not manage or miss a car insurance payment As quickly as you understand you will likely miss out on or have currently missed an automobile insurance policy repayment, call your insurance provider to let them understand you're conscious of the circumstance and also ask what you can do next.

If you've missed payment by a couple of days If you've only missed the repayment by a couple of days to a week, you likely can reinstate your policy without a lapse in protection or other severe repercussions, as you're still in the grace duration - car insurance. You'll need to pay the amount you missed out on, typically with a late settlement cost.

It's unlawful to drive without insurance in almost every state, so as soon as your insurance policy is ended, you won't be able to drive. After you have insurance coverage once more, you ought to call your state's department of electric motor cars to upgrade your insurance policy details as well as confirm that your enrollment as well as chauffeur's license are still valid.

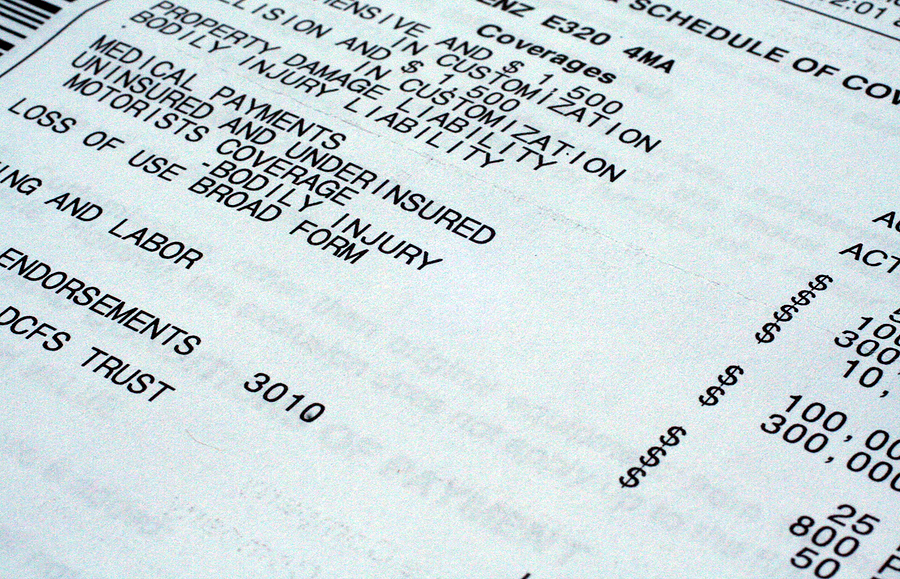

What happens when your car insurance coverage is canceled for missing a repayment? If you miss out on an automobile insurance coverage payment, you'll obtain a lawfully called for notice of cancellation from your insurance company.

After that, your insurance coverage will officially gap as well as you'll no longer be able to drive your cars and truck lawfully. In some states, allowing your insurance policy lapse also voids your registration either right away or a couple of weeks after your insurance gaps.

Not known Facts About Learn About Cancellations For Non-payment - Westland ...

Long-lasting repercussions of terminated insurance due to missed repayments If your automobile insurance coverage lapses or is canceled, whether it's as a result of nonpayment or any kind of various other factor, you will likely encounter economic ramifications of some kind. The repercussions can proceed even after you have actually reinstated your insurance coverage. Below are some feasible results of missing your auto insurance policy payments.

For example, in New york city, motorists have to pay $8 each day for as much as thirty day during which their insurance was expired, with boosted fines thereafter.: Nearly every state needs motorists to insure their cars in order to register them, and also many states need insurance provider to inform them if you allow your insurance coverage gap.

You might also be needed to carry an if you are captured driving while without insurance, especially if you create an accident (cheaper car insurance).: Insurer like to see that vehicle drivers can accurately pay their costs on schedule monthly. People that let their coverage gap, also for a brief quantity of time, will likely see a boost in vehicle insurance rates the following time they renew.

insurance auto cheap insurance company

insurance auto cheap insurance company

If your vehicle lending institution figures out you are not carrying insurance policy on the car, it may retrieve the car.: If you owe cash on your vehicle insurance as well as your insurance firm passes the financial obligation to a debt collector, it will likely impact your credit rating rating - cars. This can influence your ability to obtain a credit rating card or finance, and the disparaging mark will certainly remain on your credit history record for approximately 7 years.

If your payment is later on than the elegance period allows, your insurance can lapse (cheap car). How lengthy is the elegance duration before your insurance coverage plan lapses?

It is extremely essential to know the grace duration for your plan and also to contact your insurance company if you anticipate to make a late payment (car). Exactly how can you reinstate canceled automobile insurance policy? When your auto insurance coverage is terminated, the first thing you must do is call your existing insurance firm. If your plan has actually just lapsed for a couple days, it's feasible they can restore it.

Indicators on Car Insurance Was Cancelled For Non-payment, Missed ... You Should Know

affordable car insurance low cost money car insurance

affordable car insurance low cost money car insurance

, as well as instantly you obtain a letter, e-mail or a telephone call informing you that your policy will be canceled for non-payment. Can An Insurance Policy Firm Terminate You For Non-Payment?!? Often individuals fail to remember the settlement due day or have something come up that quit them from taking care of business.

Termination for non-payment is most likely a whole lot much more usual than you believe. The greatest mistake individuals make is neglecting the notifications, or otherwise acting quickly enough. When you learn it, you need to contact your insurance policy firm or depictive right away. This provides you the very best possibility of getting points fixed positively. cheaper.

In a worst-case scenario, be prepared to pay the complete quantity due before your policy gets terminated so that they may restore it. Insurance coverage business are usually prepared to work something out if you tell them what is going on.

Always call the firm to ensure what the treatment is to terminate as well as let them recognize your objective. Never permit a policy to be canceled for non-payment just because you don't need the insurance anymore. Insurer might do soft-credit examine your credit report as well as they additionally take right into consideration if you have actually been canceled for non-payment prior to.

They may allow you request a cancellation and stop the non-payment. In some conditions, if you did insure on your own somewhere else, you may ask your new representative to help you out by sending out evidence of your brand-new insurance coverage to the old insurance policy agent, together with a note stating that the policy is "not called for" and you have insured on your own somewhere else - insured car.

In either of these instances, offer them a phone call and also obtain it dealt with or it will certainly be a negative on your insurance background and also may quit you from getting insurance coverage or getting approved for layaway plan in the future. When Would Certainly an Insurance Policy Business Terminate Me for Non-Payment? An insurance coverage company supplies you with the regards to a payment setup when you register for your plan (insurance company).

Examine This Report on Cancellation Of Insurance Policy For Non-payment Of Premium ...

affordable auto insurance insure cheapest car car

affordable auto insurance insure cheapest car car

Your repayment setup agreement need to lay out the certain information of just how this would certainly be handled. Lots of firms, as an example, will enable mercy if you have one NSF repayment, possibly two, but after repeated occurrences, they generally reserve the right to cancel you for non-payment, despite the number of settlements have been made before the event.

car affordable auto insurance car cheaper car insurance

car affordable auto insurance car cheaper car insurance

The leading method to prevent being Website link canceled for non-payment is to communicate with your insurance policy rep and make repayment plans. Make sure you pick a settlement strategy, as well as payment frequency you can work with when you set up your brand-new insurance coverage plan and if it does not work for you when points change in your life, you can call the firm as well as ask to take a brand-new plan - cars.

A lot of the moment they will collaborate with you to obtain your plan reinstated as well as put you back on course. Call them as well as attempt and make a setup, the effects of being terminated for non-payment are severe in the insurance world, as well as you might have a tough time discovering fairly priced insurance coverage after you have a termination on file - accident.

Bear in mind, if you are having difficulty paying your insurance policy, you are additionally going to have a really tough time spending for damages if you have a loss and your insurance coverage is canceled. More than ever, when you remain in economic trouble, your insurance policy is the last point you wish to shed.

Recognizing Cancellation for Non-Payment of Plan Consequences This article is a standard to aid you recognize how cancellation for non-payment works with an insurance firm. Every insurance company has various payment plans.

Claim hello there to Jerry, your brand-new insurance policy representative. We'll contact your insurer, assess your current plan, after that locate the coverage that fits your needs and also saves you money - cheaper cars.

A Biased View of How Can They Do That? - Kentucky Department Of ...

Find out what happens if auto insurance is terminated and also why insurance coverage firms may select to do so. Bankrate alerts that an insurance coverage firm has the right to terminate your plan if you don't stick to the terms and conditions as stipulated in the policy agreement.

Cancelation Based on Nonpayment of Costs, Although losing one's plan because of nonpayment may look like an approximate reason, it's in fact among one of the most typical causes for plan cancelations. The reasons why individuals miss out on insurance payments are differed. Occasionally, people end up being so captured up in their busy lives that they merely neglect to pay their premiums.

No matter the factor, Nerd, Purse specifies that the biggest mistake people make is to ignore notices and also not do something about it as quickly as they fall back in repayments - cheap. The best course of action is to contact your insurer asap and also chat with a depictive concerning the steps you can require to attempt to save your policy.

prices cheaper auto insurance insurance cheaper car insurance

prices cheaper auto insurance insurance cheaper car insurance

To learn about certain information in this respect, you should consult your policy arrangement. What Takes place When Your Policy Is Canceled? When you have defaulted on an insurance premium, your insurer will send you a notification that your policy will be terminated if you don't make a payment.

Depending on the state where you live, losing your insurance coverage plan will certainly result in a loss of your automobile registration. Regardless of the state you live in, nonetheless, you require to take activity as soon as possible, as the issues you face without an insurance plan will just come to be worse over time.

1. FinesIn some states, vehicle drivers whose insurance policy plans have lapsed are fined. In New York, for circumstances, not having a plan will cost you $8 daily for the very first thirty days, after which the fines will certainly raise. 2. Suspension of Automobile Certificate And/Or Enrollment, In most states, it's a lawful need to acquire insurance coverage prior to you can register your automobile.

Getting The Grace Periods Extended For Insurance Premiums ... - Lsnjlaw To Work

Poor Credit Report Score, Some insurer might choose to pass you on a collection firm when you back-pedal your settlements. cheaper car insurance. Besides the hassle of frequently being troubled for repayment, debt at a debt collection agency may likewise have a negative effect on your credit rating. A bad credit report ranking, consequently, will obstruct your ability to protect a financing, get a debt card, as well as get or rent a house or an automobile.