If your services has a big fleet of lorries, with time, it may be a lot more costly to insure the fleet for physical damages than it is to preserve the risk, that is, spend for any type of physical damages directly rather than by insurance policy (likewise referred to as self-insurance). Despite how numerous lorries your company has, it may be inexpensive to carry physical damages insurance coverage only on the newer or better lorries - cheap auto insurance.

cheap insurance company vehicle insurance cheaper cars

cheap insurance company vehicle insurance cheaper cars

The most that will certainly be paid is the lesser of the ACV or the cost to fix or change the car with one of like kind as well as top quality. In the event of a total loss, the ACV is changed for devaluation and also the car's physical problem. Thus, the older the lorry and also the worse its condition, the extra its value has actually dropped as well as the less the insurer will pay - affordable.

In case of a burglary, it may return the taken automobile to you with payment for any kind of damages created by the burglary. Liability Insurance coverage The liability portion of the BACF obligates the insurance company to pay all problems business is lawfully bound to pay due to physical injury or residential or commercial property damages brought on by a protected car, approximately the plan limitations - cheap.

The decision whether to contest or clear up the case is here entirely at the insurance firm's discernment. The insurance provider's obligation to protect or settle ends when the insurance coverage limitations are worn down. By method of example, envision that 3 individuals are wounded in a mishap in which you or one of your employees is at mistake.

That leaves your organization reliant pay the award directly, must there be a judgment in favor of the 3rd person - accident. Compensatory damages may be awarded in cases of gross oversight, such as drunk or reckless driving. By legislation in several states, a BACF can not cover any type of punitive damages for which you might be responsible (vehicle).

6 Easy Facts About Compare Commercial Car Insurance - Finder.com Explained

When Your Service Car Is Likewise Your Individual Automobile Occasionally staff members or executives of a business or other persons that are supplied with a vehicle possessed by the company have just that vehicle (cheaper car). They do not possess a personal vehicle nor do they obtain personal car insurance coverage. The BACF does not cover personal use the car in this circumstance.

liability insured car suvs cheaper auto insurance

liability insured car suvs cheaper auto insurance

To safeguard your organization from these responsibility dangers you can add this kind of obligation to the BACF either under "any kind of vehicle' or "non-owned cars.", which provides protection when workers drive their own cars on service - auto. The kinds of cars that are covered are suggested by several numerical signs that show up in the statements.

An instance of irresponsible entrustment arises when a person allows another individual to use a car understanding or having reason to understand that using the vehicle by that individual creates a threat of harm to others. Any damages awarded for irresponsible entrustment would certainly be on top of obligation for the crash itself.

Just How Organization Auto Insurance Coverage Can Aid Secure You Whether you count on a single cars and truck or a big fleet of lorries, commercial automobile insurance policy is something most businesses need. That's due to the fact that a mishap can occur to even the most cautious driverand these mishaps can set you back thousands and even numerous bucks.

Generally, insurance providers suggest companies have a minimum of $500,000 for responsibility protection, but $1,000,000 is better as well as it will not include a substantial total up to the costs. You might require also greater liability limitations than the recommended quantities depending on variables such as the dimension of your car as well as the kind of materials you haul.

10 Simple Techniques For Commercial Auto Insurance Vs. Personal

A lorry bring hazardous substances, on the other hand, needs $5,000,000 liability coverage. You can see Missouri's electric motor carrier requirements in the Missouri Trucking Overview. Sorts Of Industrial Car Insurance Coverage Your business automobile insurance coverage may include the following protection depending upon your needs and also state demands: Physical injury liability: Covers you and your employees if you or a worker causes injury to one more celebration while making use of the commercial lorry Property damages responsibility: Covers you and your staff members if you or a worker triggers damage to another party's property while using the protected automobile Medical settlement coverage: Pays the medical expenditures of the vehicle drivers and travelers of the business vehicle in an accident, despite that's at mistake Crash: Pays for lorry repair services after a mishap no matter mistake Comprehensive: Spends for damage to the lorry as an outcome of theft, weather condition events or various other non-collision accidents Uninsured or underinsured driver insurance coverage: Protects you if an uninsured or underinsured chauffeur damages your industrial lorry Trailer interchange protection: Shields the trailer you make use of that is owned by an additional business Rental reimbursement with downtime coverage: Covers the expense of renting out another industrial car if your firm's vehicle needs repair work Worked with lorry insurance coverage: Gives insurance coverage if you lease industrial lorries for staff members or clients Non-owned automobile insurance coverage: Covers you if workers utilize their very own car while functioning for you Non-trucking responsibility: Shields if you utilize your commercial car for individual factors Cargo insurance coverage: Covers freight that is shed or harmed because of a mishap or various other event Bobtail insurance coverage: Safeguards you as well as your semi-trailer vehicle when you are not carrying a trailer Physical damages protection: A general term that consists of collision as well as detailed coverage What Doesn't an Industrial Car Plan Cover? Although lots of alternatives are available to aid you develop a tailored business auto plan, some points can not be covered by your business's vehicle insurance policy.

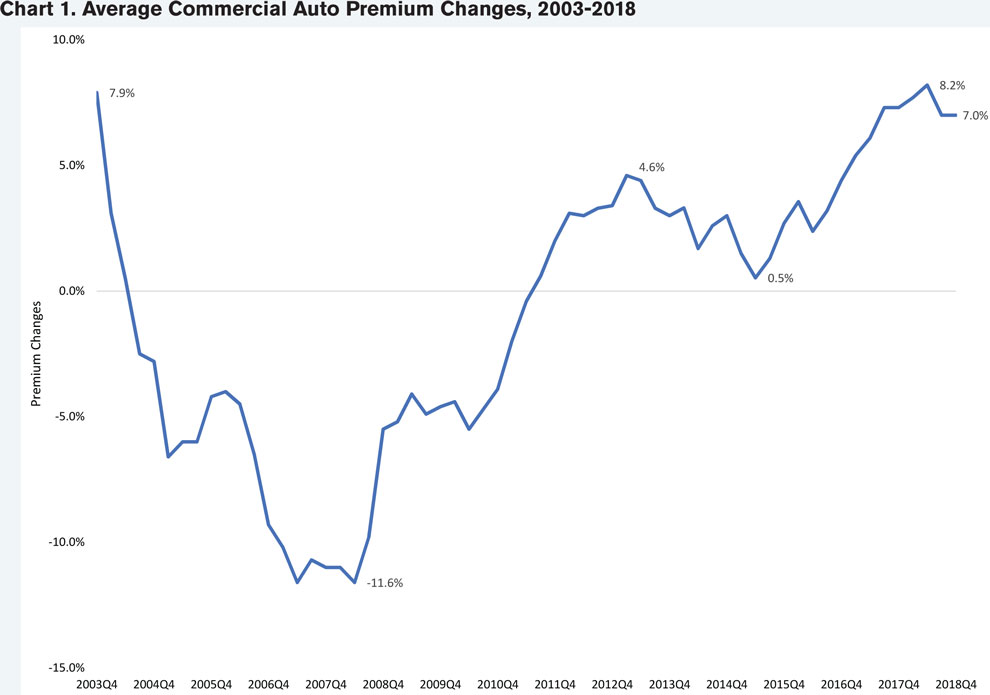

Other factors such as the state of the reinsurance market, the frequency of inexperienced vehicle drivers, greater clinical prices, sidetracked driving and also lower fuel costs influence industrial auto insurance costs - auto. Just how Do I Lower My Commercial Insurance Policy Premiums? Even though commercial car insurance features a greater price than personal car insurance policy, there are still ways to reduce your costs and also increase your business's profits (business insurance).

Last Verdict While all the suppliers we chose have excellent coverage, Progressive Commercial attracted attention to us because it is the biggest commercial automobile insurance coverage provider and uses additionals at no additional expense. The most effective industrial auto insurance coverage for your business will rely on several variables, including the dimension of your fleet, which vehicles your workers make use of, as well as just how frequently they drive (car insurance).

How Is Commercial Cars And Truck Insurance Different From Personal Car Insurance? Commercial car insurance coverage is similar to personal car insurance in that it financially shields you or your employee in the event of a mishap. low cost. Nonetheless, although business car insurance policy covers your lorry for personal usage, personal automobile insurance coverage does cover your vehicle for company use.

How We Selected the Ideal Business Automobile Insurance We assessed virtually 2 dozen commercial vehicle insurance service providers based upon monetary stamina, client service and declares complete satisfaction, coverage provided, and price cuts given. We additionally paid interest to any kind of one-of-a-kind attributes given as well as provided preference to firms that had some rates details online or given on the internet quotes (low-cost auto insurance).

Our Cheap Commercial Auto Insurance Statements

Taking care of damage to a lorry can be expensive for more than one reason. Industrial automobile insurance coverage covers the cost to fix or replace the vehicle (less devaluation), as well as the cost to lease a substitute vehicle so your organization can proceed running. Commercial auto insurance coverage can provide medical expense coverage as well as uninsured vehicle drivers coverage to individuals guaranteed on the plan.

We contrasted elements such as availability, customer complete satisfaction scores, rates, monetary stamina scores, as well as protection choices. We additionally thought about the simplicity with which company owner can acquire a policy, make changes to their protection, and submit an insurance claim if required.

Aspects That Can Influence Your Commercial Auto Price Similar to the costs you pay for your individual automobile policy, there are many variables that might influence the price of your commercial vehicle insurance plan also. Generally, the list below aspects have a tendency to affect your business car insurance policy rate, though they might vary by insurance provider, state, and service. cheapest.

That exact same flower shipment vehicle might cost much less to guarantee if it provides blossoms in country Tennessee than if it supplies blossoms in the heart of Dallas, Texas (accident). There are a variety of industrial car insurance coverage coverages for you to pick, from the most basic insurance coverages like Bodily and Residential Property Damages Obligation, to optional protections like Permissive Usage and Medical Payments.

Cars that deliver people have a tendency to be slightly extra costly, and also sturdy cargo cars handling loads over of 10,000 pounds often tend to be one of the most costly to insure. As your service's obligation risk goes up, so might the expense of insurance coverage. This may be one of the most crucial variables when it comes to approximating the price of commercial auto insurance coverage, and also for a couple of reasons (money).

Facts About The Best Commercial Car Insurance For 2022 - The Balance ... Uncovered

Second, workers with bad driving documents may cost you more to guarantee, or might stop you from getting the insurance coverage you need entirely - insurance affordable. Decreasing Your Business Vehicle Insurance Policy Prices While the cost of business auto insurance varies substantially relying on your company and the insurance company you pick, there are typically a handful of means you can potentially lower your commercial automobile insurance coverage prices (trucks).

auto insurance cheap car insurance affordable auto insurance cheaper

auto insurance cheap car insurance affordable auto insurance cheaper

What is industrial car insurance coverage? Commercial car insurance coverage, also referred to as service automobile insurance policy, is an automobile insurance plan created for automobiles that are utilized by and also for organization purposes. These insurance coverage policies can protect your employees and also other motorists if there's a mishap or perhaps if a vehicle is harmed while it's not in use. insurance.

Business vehicle insurance policy can cover a range of cars used for business such as distribution trucks, work vans, building and construction automobiles, food trucks, as well as standard firm cars and trucks. Just how is business auto insurance policy different from personal car insurance coverage? Several local business owner assume that their individual car insurance policy will certainly cover them if they remain in a wreckage, yet that's not constantly the situation (dui).

Freight vans and delivery lorries are extra pricey, normally costing about $3,300-$6,200 annually. Business car insurance policy expenses differ based upon the quantity of protection you have, the number of vehicles covered by the policy, as well as the kind of automobiles on the plan. Premiums can likewise depend upon how high-risk your industry is (such as building and construction or demolition), the driving history of the chauffeur, and also other advantages consisted of in the policy.

insurance vehicle insurance automobile auto

insurance vehicle insurance automobile auto

It will likely still be covered under the business car plan, but you'll require to include the proper info in the declarations section of your plan. If your work lorry is scheduled on your service vehicle plan and also you correctly proclaim that workers may utilize the automobile for personal usage, your automobile is covered by the service auto plan.

How Much Does Commercial Auto Insurance Cost? - Get Quotes - An Overview

What is industrial automobile insurance policy? Business auto insurance policy is a sort of insurance coverage policy that covers lorries used for business purposes. Any cars and truck that is used for business-related functions should be covered by business insurance coverage, whether it's a van, pick-up truck, box truck, energy vehicle, food truck or a routine vehicle.

For one, business automobile insurance coverage can only be used for company vehicles. Common auto insurance coverage covers automobiles for individual use travelling, running tasks, carpooling, etc.

As a result of that, business auto insurance coverage is much more pricey than individual insurance. If you have the business that insures industrial autos, you might be able to assert a tax obligation deduction on your business cars and truck insurance. This won't apply if you are listed as a motorist on your company's industrial car plan.